Germany’s Klim raises $22M to take its regenerative farming platform worldwide

[ad_1]

Worldwide meals manufacturing generates not lower than 1 / 4 of greenhouse gasoline emissions, better than 80% of which comes from agriculture. Nonetheless addressing that have an effect on is easier said than executed since there are simply so many shifting components to cope with.

“Regenerative” farming is often touted as one resolution to make progress in direction of a variety of sustainability targets, as a result of it offers farmers a risk to reduce carbon emissions whereas rising biodiversity and enriching soil. That straight impacts meals manufacturing, and subsequently, meals present.

Berlin-based agritech startup Klim is working to get farms to switch to regenerative farming further merely, and to help broaden its operations internationally, the startup not too way back secured a $22 million Sequence A funding spherical led by Europe’s largest monetary establishment, BNP Paribas. Notably, the spherical is among the many largest raised by agritech startups in Europe this 12 months.

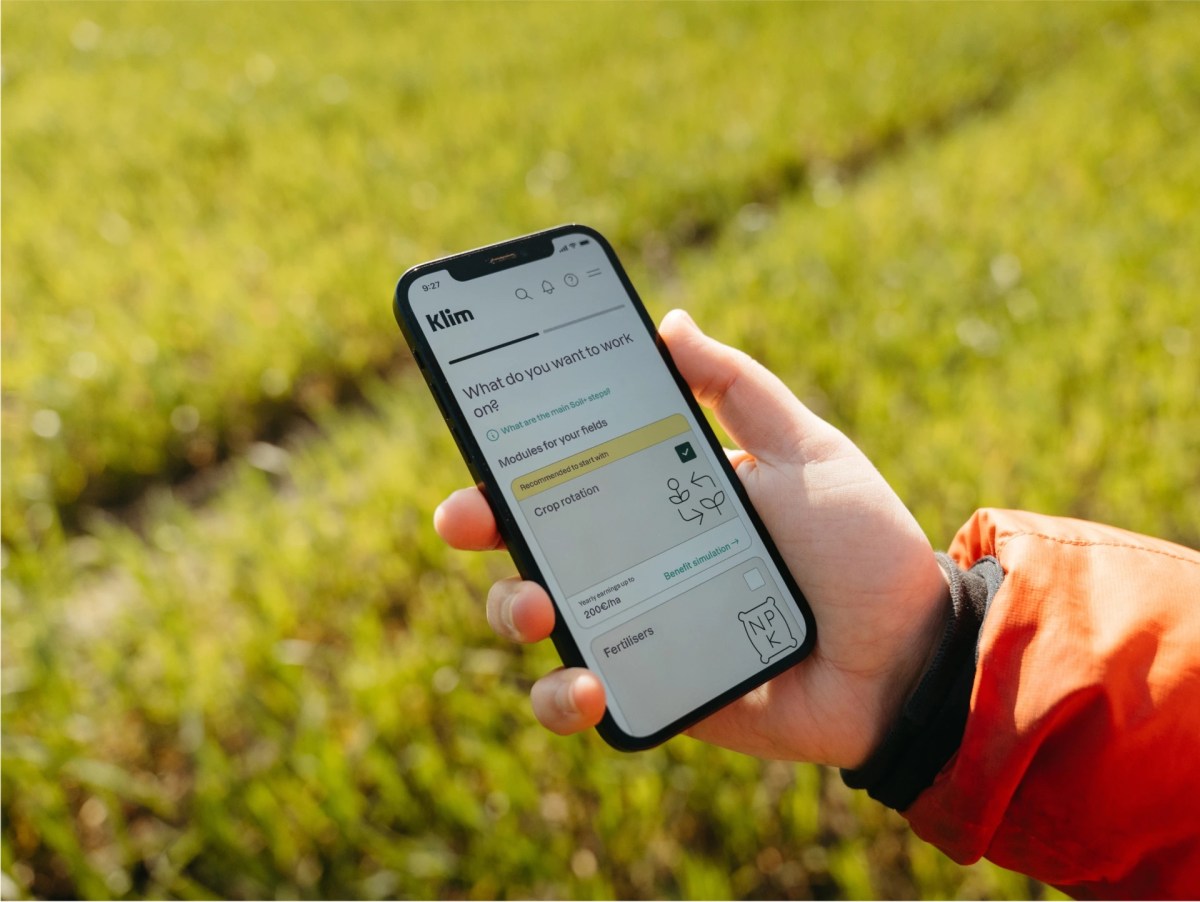

With Klim, farmers get devices to plan, execute, and finance the transition to regenerative practices. This accommodates data on restoring soil properly being, biodiversity, capturing carbon, and decreasing emissions.

Farmers can also use Klim’s platform to hint the progress of their transition and present it to supply chain companions, enabling them to earn revenue payouts for sequestered carbon. Klim then takes a payment on the sale of carbon “insets” linked to supply chains, and farmers can generate revenue from these by selling them on Klim’s market.

In flip, meals corporations should purchase these “ecosystem suppliers” to make their present chains greener, notably as emissions reporting requirements improve. In numerous phrases, a farmer will receives a commission for “farming carbon” as rather a lot as elevating and selling crops or cattle.

Klim was primarily based in 2020 in Berlin by Robert Gerlach, Nina Mannheimer, and Adiv Maimon, and beforehand 4 years, the startup says it has served 3,500 farmers, which equates to 700,000 hectares of land, representing 5% of German farmland. Its customers now embrace agriculture giants like Nestlé, Kaufland, and Aryzta.

Chatting with TechCrunch, Gerlach (CEO) said that given the world is frequently shedding further soil, and plenty of world soils have already misplaced 50% of their genuine pure carbon stock, “there’s an precise urgency to transition farmland to regenerative practices.”

“It is best to do two points to get a farmer to regenerative agriculture. The first is a digital agronomist that reveals them straightforward strategies to best start for his or her particular farm’s context. This accommodates straightforward strategies to cut back the prospect, for example, starting with solely 5% of the farm, selecting the right methods,” Gerlach said.

He said the second issue is to quantify the have an effect on: “We do this with a combination of satellite tv for pc television for laptop data, soil samples, and first data that the farmer has to put into the platform, which then all goes into a licensed model. That quantifies the emission removals and reductions. Nonetheless it will likely be a misunderstanding to say we’re used for carbon offsets.”

“What corporations like Nestlé really need is reliability. Present chains are degrading, which implies harvests are a lot much less predictable. That’s really problematic for the meals corporations,” he added.

The model new funding can be utilized to broaden the company’s operations outside of Germany.

Klim is not going to be alone on this home, notably in Europe, the place agritech is a well-developed sector. For example, Agricarbon, based in Dundee, Scotland, measures and validates soil carbon seize and storage for farms and carbon markets, and it has raised over €14 million. One different competitor, Regrow, has raised $63.6 million, whereas Soil Capital has raised €5 million.

“Klim’s revolutionary platform and methodology to scaling regenerative agriculture are utterly aligned with our dedication to financing choices that mitigate native climate change, make the ecosystems further resilient and improve of us’s livelihoods,” Maha Keramane, head of BNP Paribas’ Optimistic Have an effect on Enterprise Accelerator, said in an announcement.

Klim’s Sequence A spherical moreover seen participation from Earthshot Ventures, Rabobank, AgFunder, Norinchukin Monetary establishment, Achmea, Ananda Have an effect on Ventures, and Elevator Ventures — the VC arm of Raiffeisen Monetary establishment Worldwide. In 2022, the startup closed a $6.6 million seed spherical that was led by Berlin-based meals and inexperienced tech investor, Inexperienced Period Fund.

[ad_2]

Provide hyperlink

Post Comment