Former Raya, Dispo exec has a model new fund for the biggest out-of-favor tech: consumer

[ad_1]

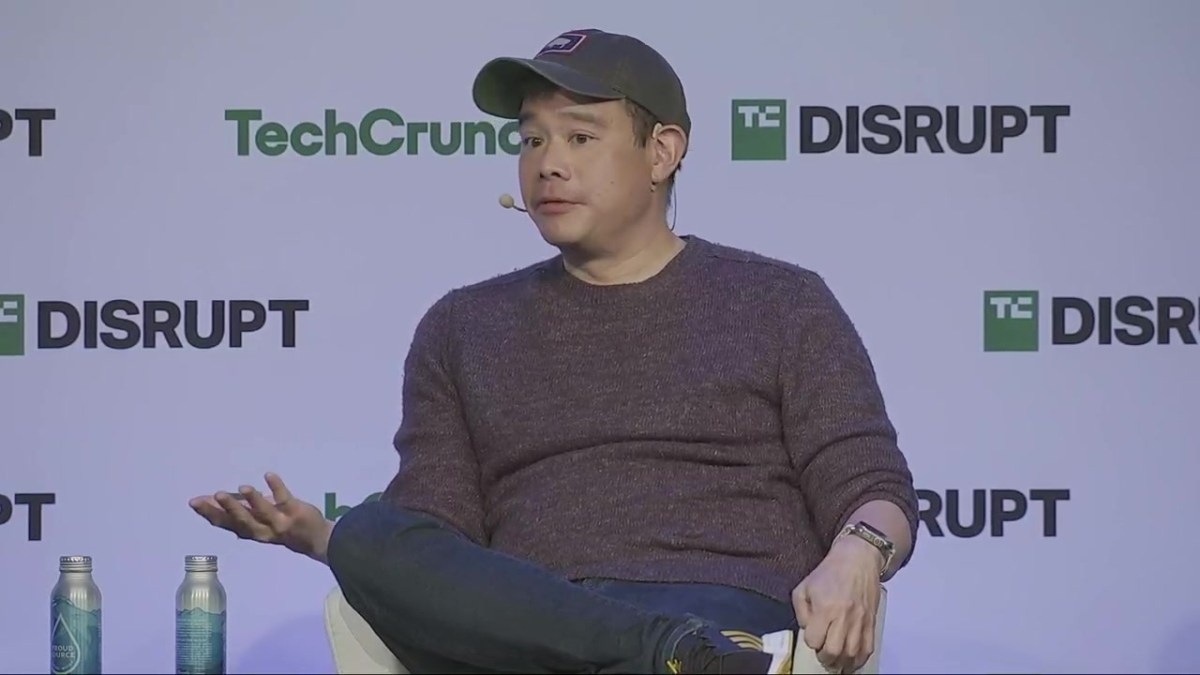

The considered sooner or later turning right into a enterprise capitalist on a regular basis loomed behind TJ Taylor’s ideas.

In any case, he had an intensive tech background. He co-founded a stock app and labored in neighborhood on the courting app Raya and the photo-sharing app Dispo. After leaving Dispo on the end of 2022 he found himself in a model new situation. “It was the first time I didn’t know what was subsequent,” he suggested TechCrunch.

He wandered a bit, launching a startup consultancy the place he acknowledged he beloved working with early-staged teams. “Just some people from my neighborhood merely point-blank acknowledged to me, ‘Why don’t you focus on starting your particular person small fund?’” he recalled. “I was like, ‘I don’t even know the place to begin out.’”

So he grew to develop into a scout at Headline, discovering his footing in an enterprise that, on the time, was going via a historic downturn. Headline focused a lot on Sequence A and up, however Taylor on a regular basis found himself attempting to cross alongside early-stage provides. When Headline would cross he would ship it out to his private neighborhood until he realized successfully, his buddies had been correct — he ought to easily launch his private fund.

So he established Hobart Ventures, named after certainly one of many streets Taylor grew up on in South Central Los Angeles. He started engaged on it last December and publicly launched it just some days up to now with some LPs already in tow. The company is elevating an $8 million fund dedicated to early-stage consumer startups. He hasn’t invested from the fund however though says he has some startups to which he’s eager to cut checks. The standard confirm measurement shall be between $150,000 and $300,000, he acknowledged.

His give consideration to consumer is a pure match given his background. Shopper startups could possibly be a hit or miss with patrons. Some are pretty bullish on the category whereas others sigh at its level out. Nonetheless, as Taylor recognized, consumer is a very massive class: Carta information found that consumer tech raised 7.1% of all enterprise funding last 12 months, a slight dip from the years sooner than nevertheless better than {{hardware}}, energy, and crypto.

“As know-how modifications, macroeconomic native climate modifications, behavioral shifts happen, generational shifts happen. That presents different, correct?” he acknowledged, noting that society goes via a shift correct now. “Shopper spending stays to be scorching, correct? Clients are nonetheless spending money. Clients will on a regular basis uncover an answer to spend money.”

He says fundraising the fund hasn’t been too robust, though notices patrons are nonetheless not once more to the free-flowing days of the ZIRP interval. Nonetheless he’s optimistic about the way in which ahead for the enterprise, significantly if the IPO market opens once more up as soon as extra and LPs can start getting earnings, returns, and in a position to reinvest. “I imagine clearly with charges of curiosity cuts coming, there shall be further side-lined LPs’ money or hopefully some distribution once more to LPs to make investments in funds and startups.”

[ad_2]

Provide hyperlink

Post Comment